China has recently added seven rare earth metals to its export control list due to escalating trade tensions, creating significant risks for Western industries but simultaneously opening new investment opportunities.

Strategic Importance of Rare Earth Metals and China’s Dominance

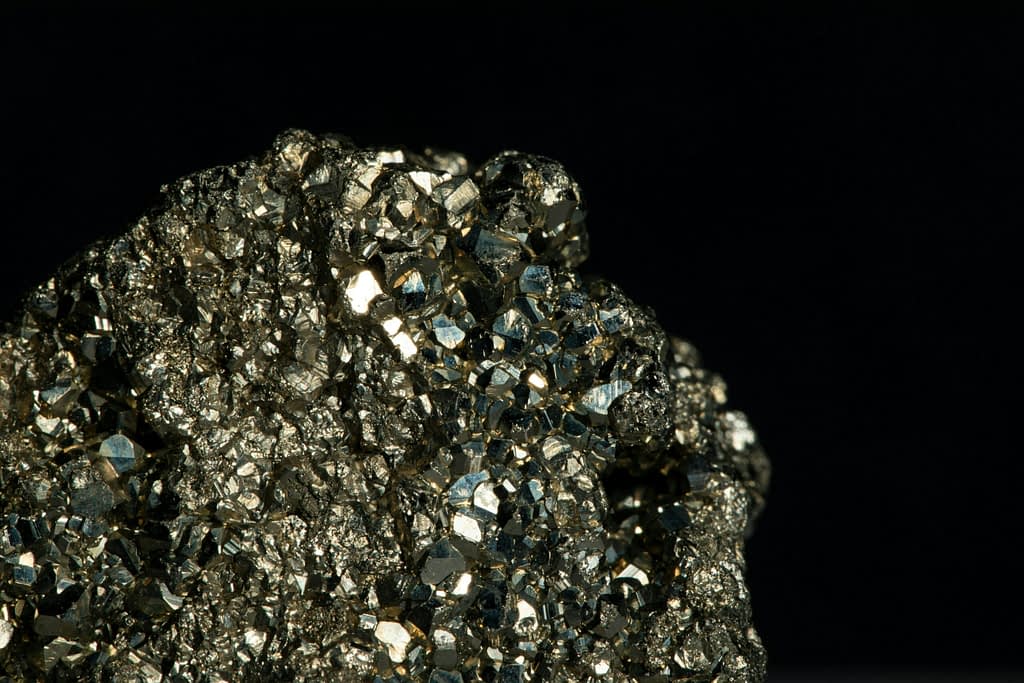

Rare earth metals are key components in a wide range of products from fighter jets to nuclear reactors and smartphones. Although these metals occur relatively commonly in the Earth’s crust, concentrated deposits are rare and their processing requires a complex multi-step process. China controls not only mining (69% of global production) but especially the vast majority of global refining capacity.

The United States, by contrast, has almost no processing capabilities for the targeted metals, creating a critical dependency and simultaneously an investment opportunity for companies that can fill this gap.

Seven Strategic Metals and Their Applications

The seven metals on China’s control list include:

- Terbium: Used in light bulbs, smartphone displays, and adds resilience to magnets in aircraft, submarines, and missiles. It’s one of the most difficult elements to source, making up less than 1% of the total rare earth content in most deposits.

- Yttrium: Used in liver cancer treatment, in lasers for dental and medical surgeries, and increases the strength of alloys. The US imports approximately 93% of yttrium compounds from China.

- Dysprosium: Resistant to high temperatures, primarily used in alloys for magnets in motors or generators, wind turbines, and electric vehicles. Australia’s Lynas Rare Earths Ltd. plans to expand its plant in Malaysia to produce dysprosium and terbium by June.

- Gadolinium: A key element for contrast agents in magnetic resonance imaging. It also improves the performance of alloys and their resistance to high temperatures and oxidation.

- Lutetium: A hard and dense metal used as a chemical catalyst in oil refineries. The US purchases almost all its supply of this metal from China.

- Samarium: Samarium-cobalt alloys are on the US list of critical metals for potential stockpiling. Used in supermagnets in turbines and automobiles due to its ability to remain magnetic at higher temperatures.

- Scandium: Used in making components for fighter planes, baseball bats, and bicycle frames due to its low density and high melting point. Scandium hasn’t been produced in the US for more than 50 years.

Investment Opportunities and Future Development

China’s export control of these metals creates a significant investment opportunity for companies outside China that can develop alternative supply chains. Potential investment targets include:

- Mining companies outside China – Particularly Australian and American companies focusing on rare earths, such as Lynas Rare Earths, which is already expanding production of dysprosium and terbium.

- Processing capacities in Western countries – MP Materials reopened the Mountain Pass mine in California’s Mojave Desert in 2018, the only operational rare earth mine in the US, which now also has refining capabilities.

- Recycling technologies – Companies developing methods to recover rare metals from electronic waste represent another investment opportunity with growing potential.

- Research and development of alternatives – Companies focused on researching substitute materials that could reduce dependence on rare earths.

While neodymium and praseodymium, two of the most common rare earth elements used in permanent magnetic motors, are not currently on China’s control list, the US has begun producing these two metals on a limited scale. Last year, the United States produced 1,130 tons of refined neodymium-praseodymium, compared to more than 58,300 tons produced in China.

For investors, the current situation presents a unique opportunity to enter a sector that will gain strategic importance in the coming years. Given the tension between the US and China, significant investments in developing alternative supply chains can be expected, which could lead to rapid growth in the value of companies operating in this segment.