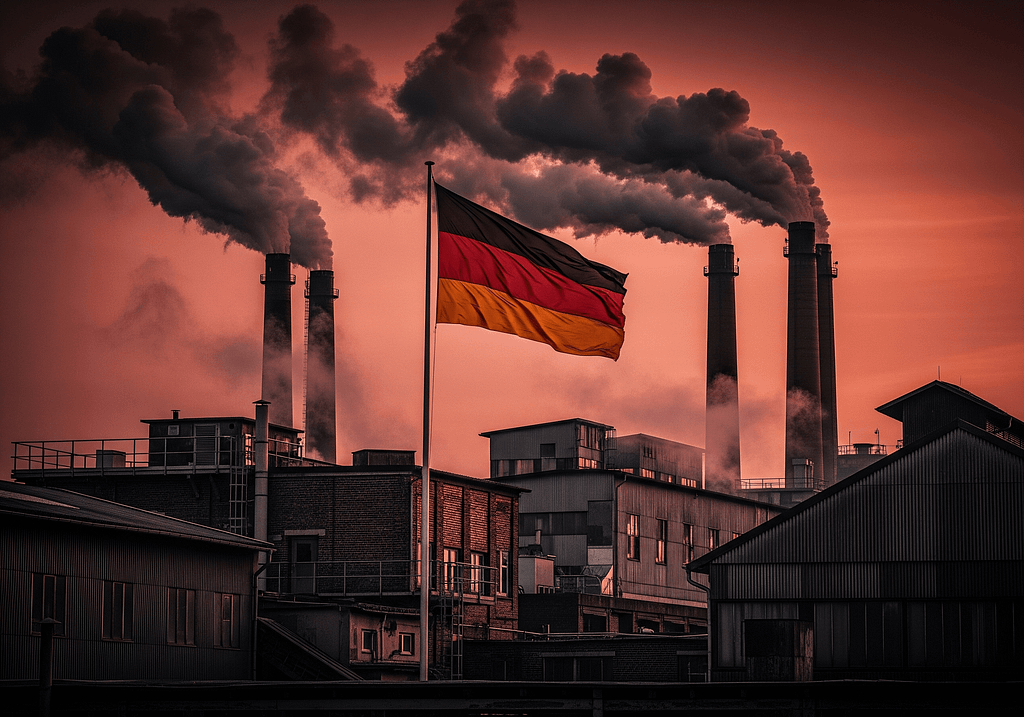

The German economy has slipped back into recession with GDP declining 0.3% in the second quarter of 2025. The country’s share of global exports fell over the past decade from nearly 10% to 7.5%, while China strengthened from 12% to 16%. The automotive industry faces American tariffs up to 25% and Chinese competition in domestic markets.

China Pushes Germany Out of Global Markets

The biggest challenge for German exports has become China, which acts as a dual threat. German companies are gradually losing their positions in the Chinese market, which was crucial for selling luxury cars and specialized machinery. Simultaneously, Chinese manufacturers are expanding into foreign markets in segments traditionally dominated by Germany.

Chinese expansion has hit a broad spectrum of industries – from automotive through medical devices to sophisticated machinery. For German companies, this means losing market share not only in China itself, but also in third-country markets where Chinese products offer competitive prices with rising quality.

American Tariffs Devastate Exports to the USA

The situation is dramatically worsened by new trade barriers from the United States. Approximately one-tenth of German exports goes to the USA, where this year the tariff rate on German goods increased from one percent to more than 15%. The automotive sector faces even tougher conditions with tariffs up to 25%.

The impacts are measurable:

- Exports to the USA fell by nearly 10% year-on-year

- Mercedes and BMW face dramatic price increases in their largest foreign market

- Some automobile categories have become practically uncompetitive

German GDP Falls, Industrial Production Plummets

German GDP declined 0.3% in the second quarter of 2025, meaning an official return to recession. Industrial production has fallen by 12% since 2018, and nearly a quarter million jobs in industry have disappeared from the market, primarily in automotive companies. The social impacts are significant – regions dependent on industry are struggling with rising unemployment and public confidence in the future is weakening.

According to the German central bank, the main problem is not declining global demand for industrial products. Three-quarters of the loss in export shares stems from internal weaknesses:

- Shortage of skilled workers

- Complex regulations and high labor costs

- Expensive energy after nuclear plant shutdowns and the Russian energy crisis

- Slow digitalization and demographic aging

The energy crisis represents a particularly pressing problem. After shutting down nuclear plants and subsequently the Russian energy crisis, energy costs have become a significant burden for German companies, disadvantaging them against competitors from other countries.

Government Program Worth 600 Billion Euros Aims to Reverse the Situation

Chancellor Friedrich Merz’s government has presented the “Made for Germany” program with investments exceeding 600 billion euros in infrastructure modernization, digitalization, and green technologies through 2028. A fiscal package of up to one trillion euros is also being prepared to accelerate bureaucratic processes and support private investments.

Another option is greater emphasis on trade within the EU, where according to the International Monetary Fund, barriers still exist equivalent to tariffs of up to 44%. Their removal could partially compensate for losses on the China-America front. However, the problem is that German business associations have resisted deeper integration because they fear greater competition in the domestic market.

Investment Opportunities Amid Crisis

For investors, today’s Germany presents a mixed picture with clearly defined risks and opportunities. Threats include continuing recession, automotive industry decline, and falling competitiveness. On the other hand, new possibilities are opening in green transformation, digitalization, and infrastructure projects.

The current crisis may force a fundamental change in the economic model. Germany has historically built almost everything on industrial exports, while the services sector remained somewhat sidelined. The future may demand the opposite approach – strengthening services, technology start-ups, and the digital economy.

Government investment packages and modernization pressure create space for companies in energy, technology, and construction. Long-term investors should monitor not only traditional industrial icons, but also smaller technology companies supported by state programs.

Germany stands at a crossroads. If it manages to use the current crisis as an impulse for modernization, it can regain the position of European leader on different foundations than before. But if it wastes the opportunity for reforms, it risks transforming from an “export machine” into a weak link in the European economy.